The illicit tobacco trade is a serious problem in the country. It threatens farmers, consumers and legitimate business owners while depriving the government of much-needed tax revenues at a time when the budget deficit is at an all-time high. It is estimated that 2 million Filipinos, directly or indirectly, depend on the tobacco industry.

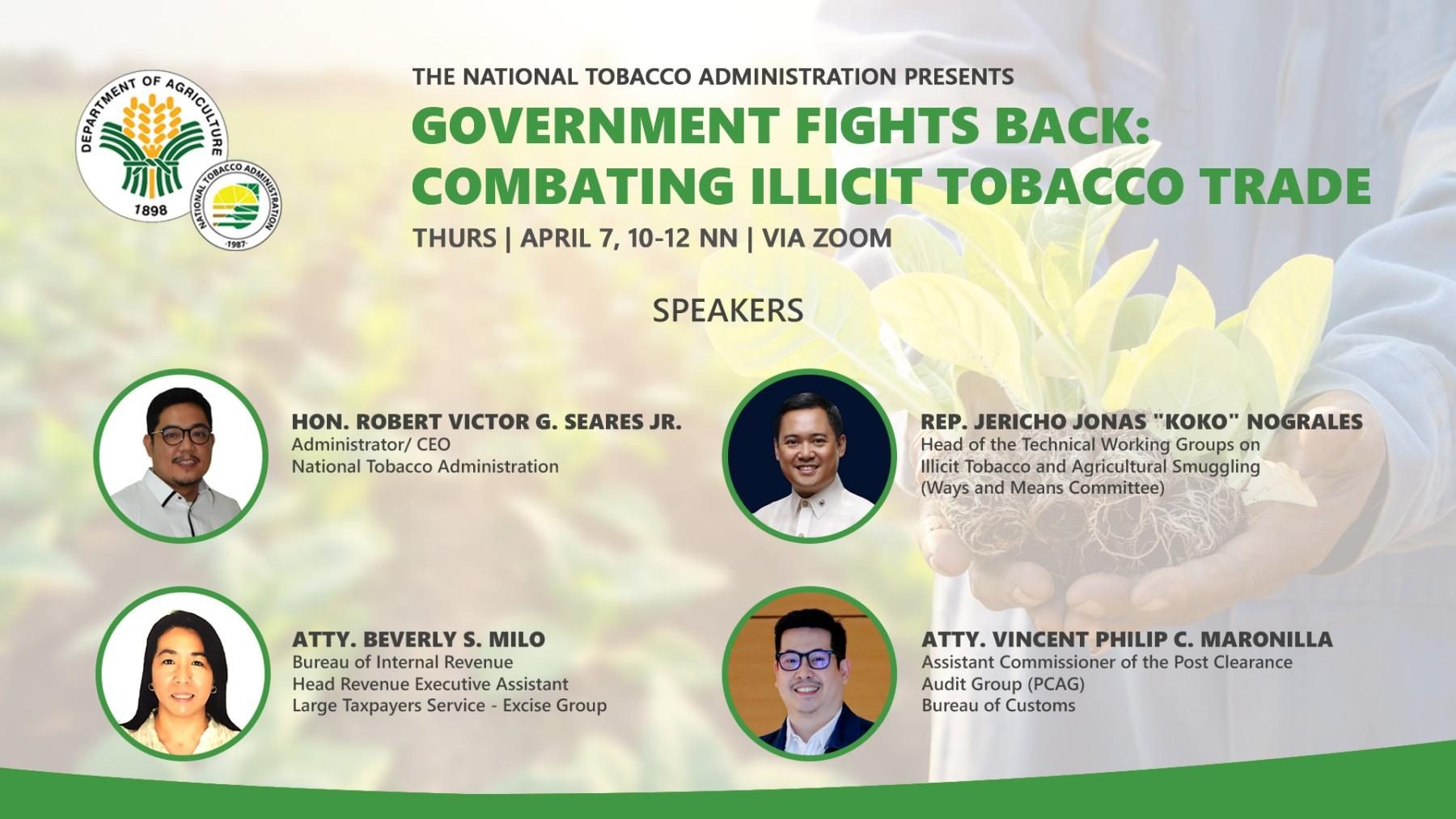

To discuss the latest findings and measures to combat illicit tobacco trade in the Philippines, the National Tobacco Administration (NTA) mounts “Government Fights Back: Combating Illicit Tobacco Trade” on April 7 at 10 a.m. The discussion will gather lead government agencies to shed light on this clear and present danger.

According to the International Monetary Fund (IMF), the annual revenue loss in tobacco taxation worldwide is valued at $40-50 billion – that is, about 600 billion cigarette sticks, or 10% of global consumption.

In ASEAN, $3.3 Billion in tax revenues are lost from smuggled cigarettes annually, based on figures revealed in “Tackling Illicit Trade IN ASEAN Advocacy Paper 2020” by the EU-ASEAN Business Council and Transnational Alliance to Combat Illicit Trade or TRACIT.org.

According to the House Ways and Means Committee, the Philippines is losing as much as P60 billion pesos in revenues due to illegal cigarettes.

In 2021, the BIR collected nearly P180 billion in excise taxes from the tobacco industry alone. Revenues collected from the tobacco industry are used to fund the country’s Universal Health Care program, the Department of Health’s Facilities Enhancement Program, economic programs of LGUs in tobacco-producing provinces, among others.